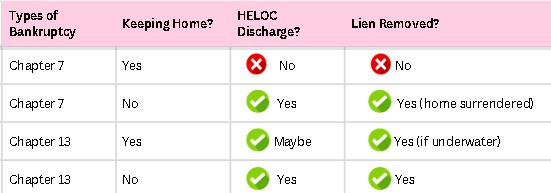

- If you’re surrendering the home: You can discharge the HELOC just like any other unsecured debt. Once the house is out of your name, the lien goes with it.

- If you’re keeping the home: The HELOC remains attached. Even though the personal obligation may be discharged, the lien survives, and the lender can still foreclose if you stop paying.

- Your home must be worth less than your first mortgage.

- Your attorney must file a motion to strip the lien.

- You must complete your 3-5 year Chapter 13 plan to fully remove the lien.

🗝️ Real-Life Example:

A client in Los Angeles owed $50K on a HELOC, but their home was worth less than the first mortgage. We filed Chapter 13, stripped the HELOC, and they paid pennies on the dollar—saving their home and releasing the second mortgage forever.

⸻

🧠 FAQ: HELOCs & Bankruptcy

Q: Can I keep my home and still discharge the HELOC?

A: Only in Chapter 13, if your home is underwater.

Q: What happens to the HELOC lien if I move out?

A: If you surrender the home in bankruptcy, the lien typically goes away when the home is foreclosed or sold.

Q: What if I just stop paying the HELOC?

A: The lender can foreclose. Bankruptcy gives you protection and potential discharge—don’t just ignore it.

⸻

👩🏽⚖️ Need Help With a HELOC in Bankruptcy?

At the Law Office of Chirnese L. Liverpool, I help clients in California and Nevada eliminate debt, protect their homes, and navigate complex bankruptcy cases with confidence and compassion.

Whether you’re filing Chapter 7 or Chapter 13, let’s talk about the smartest way to deal with your HELOC.

📞 Call now: 818-714-2200

🌐 Visit: www.LiverpoolLegal.com